3 ways to use surveys to quickly figure out your next step when you don’t know what to do

How do you choose your next step? You’d like to do more of what’s working, but sometimes you’re not sure what parts of what you’re doing are working, or whether that pivot you’re considering might resonate with your target market, so you’re not sure what you should do more of or where to focus your efforts. In this post, I demonstrate three ways to use surveys to quickly get the data you need to make an informed next step.

What is a survey?

A survey is a research method that relies on gathering data in order to better understand something. Because the questionnaire is so frequently used as the sole data collection tool of a survey, the terms are often used interchangeably, but surveys can also employ interviews and focus groups.

Surveys don’t require long lists of questions. Depending on your goals, they can be as simple as a single question.

And that’s where I’m going to start – with a social media poll.

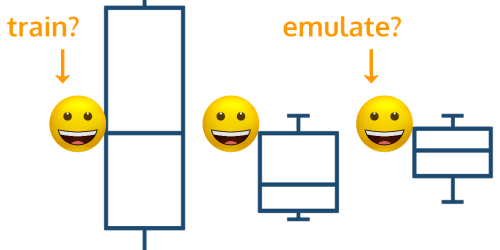

Survey #1: A Social Media Poll for Data Collection

I’m going to focus on the LinkedIn and Twitter platforms, both of which let you specify a single question with up to four options. You can run your poll for up to two weeks on LinkedIn, and up to seven days on Twitter. This is great when you want to get clear on how people are defining a concept, or you want to take a bead on interest on a certain topic. Just be sure you know what you want to do as a result of what you find out – so that your question and the responses are targeted towards that goal.

Suppose you’re wondering if you should write a book on a niche within your area of expertise, but you also want to plant a seed of interest for those that haven’t considered it before. You could ask a simple question like “Do you think recorded video is an important part of your sales funnel?” with options for Yes, No, and Not Sure.

Suppose instead you’re interested in how best to tailor your content generation efforts. This time the poll reads “If you could learn just one thing about using data for business, it would be how to….” with the following four options: Make better decisions, Improve processes, Tailor products & services, Other (please comment).

In situations like the latter, as a catch-all, I always like to leave the 4th option listed as “Other (please comment),” so I have room to collect the unexpected. Then, unless I’m asking for the best or top of most important thing from a list, in which case the options can overlap, I write the other three options to be mutually exclusive.

You’ll analyze these results not just in terms of the poll responses, but also in terms of “who” your respondents were and how representative you think they are of “who” you’re trying to assess. Polls like these can also be a way to get some ancillary data, like what kind of engagement you can expect from your network, what kind of reach you have, and what assumptions and biases you’re building into your approaches and questions and options.

Survey #2: Long Questionnaires for Data Collection

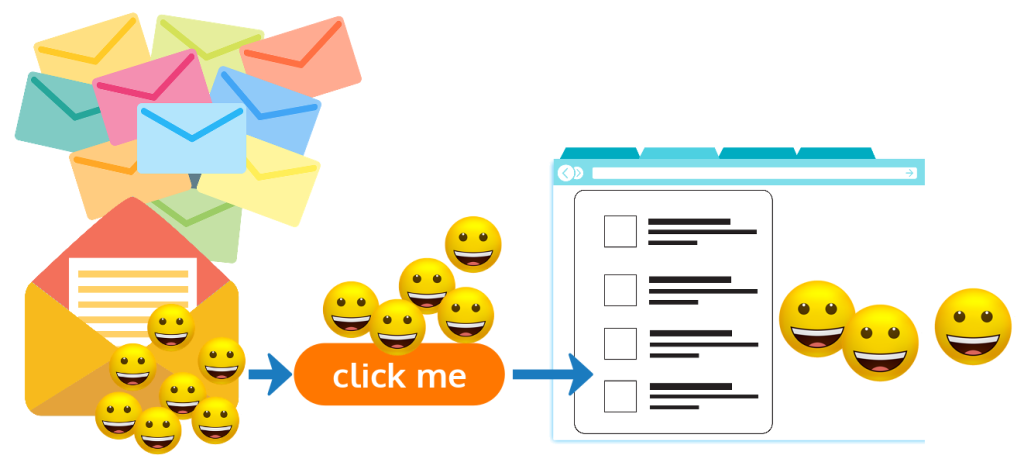

For the next survey, I’m going to jump to the other end of the spectrum and talk about long questionnaires. So that my survey doesn’t get caught up in bizarre technical difficulties, I like to implement longer questionnaires as a web form using something like Google Forms (opens in new tab). Instead of social media, I’ll use my email list to distribute the request for the survey, and use that to deliver a link button that takes respondents to the questionnaire. This will let me track who opens the email, who clicks on the survey, and then also who fills it out.

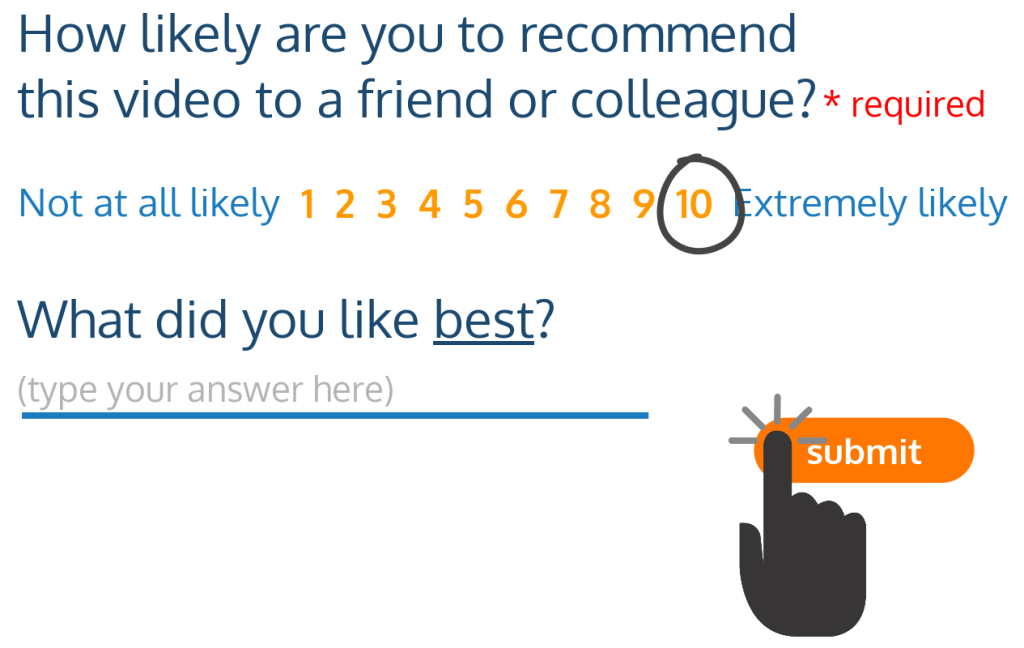

For longer form questionnaires like this one, it’s a good thing to make most of the questions optional, only requiring the one that’s really essential, like a Net Promoter Score, with only a few optional follow-up questions for more information. This way, the questionnaire doesn’t seem like a huge time burden for your respondents, and they’re more likely to respond.

Survey #3: An Email Poll and a Long Questionnaire for Data Collection

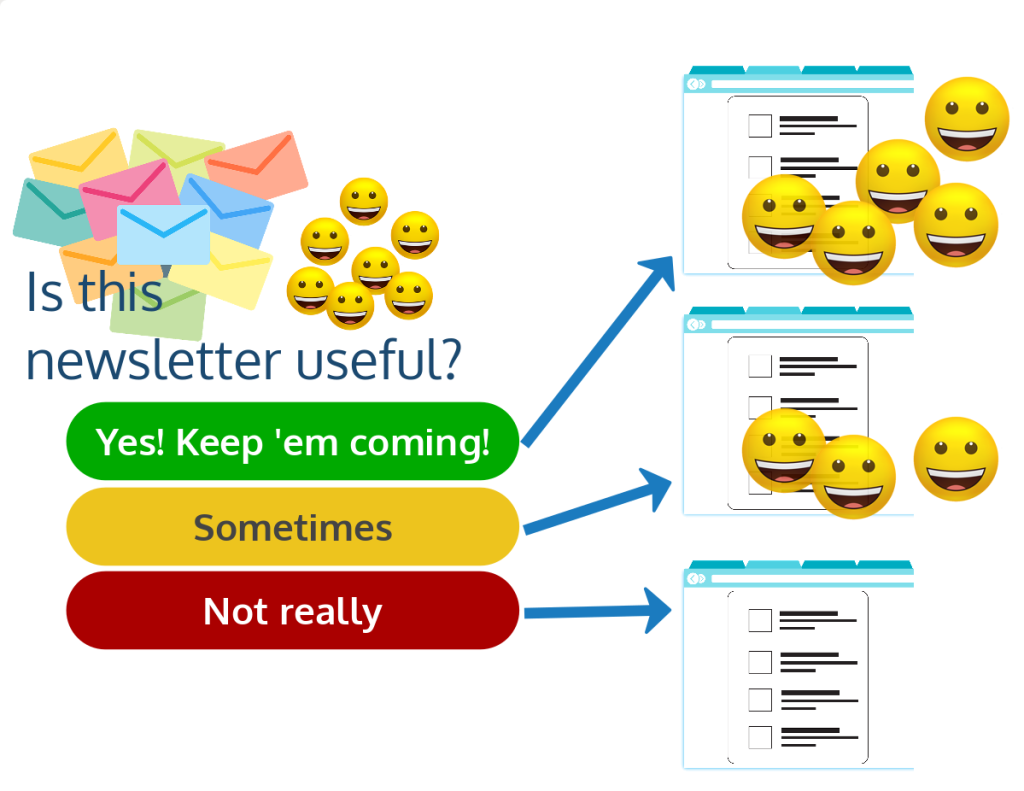

As a final survey example, I’ll demonstrate a hybrid approach of a poll plus a longer questionnaire. Again, I distribute this one as an email. Instead of the email button just taking respondents to a longer questionnaire, the link buttons themselves serve as the first question, much like a poll. Responses to this poll then open a longer form follow-up questionnaire that’s 100% optional, and customized to the poll response.

As with the other surveys, this one provides a lot of ancillary data, like who opened the email, the initial (and required) response you’re looking for, and some optional follow-up for more nuance.

Ready to design and use your own survey?

If you would like to talk to me about how to design and use surveys as part of your business strategies, you can schedule a Zoom meeting with me.